About the ERC

The Employee Retention Credit (“ERC”) was enacted by the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act, to encourage employers to keep employees on their payroll even if those employees were unable to work in the same capacity or at all.

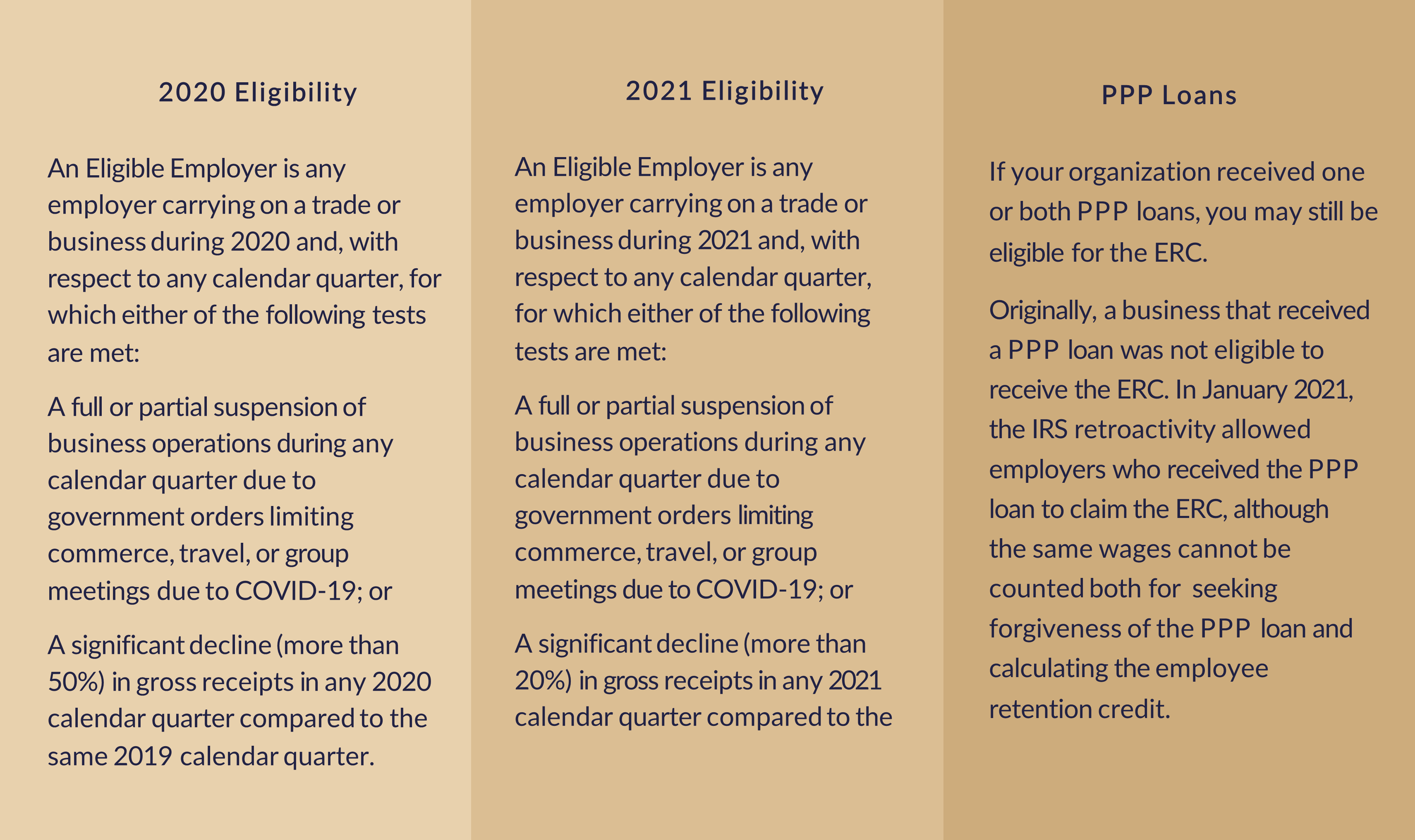

The ERC is a fully refundable tax credit for employers with eligibility analyzed on a quarter-by-quarter basis.

The maximum credit available is $26k per W2 employee.

Eligibility

About Us

Barnwell works with organizations to determine their eligibility for the ERC and provide analysis pursuant to the relevant guidance. We review payroll and other records to determine eligible wages and calculate the credit for each quarter, taking into consideration PPP funds and any other tax credits. We assist clients with claiming the credit on applicable Form(s) 941. We work on a success fee basis, and our fee is only due after the company receives the cash benefit from the IRS.